Surety protection for debt collector customers.

Learn more about collection agency bonds.

A collection agency, also known as a debt collector, is an entity typically used by creditors to collect consumer debt that the creditor has not been able to recover. A collection agency performs this service in exchange for a fee or percentage of the recovered debt.

Collection Agency Bonds

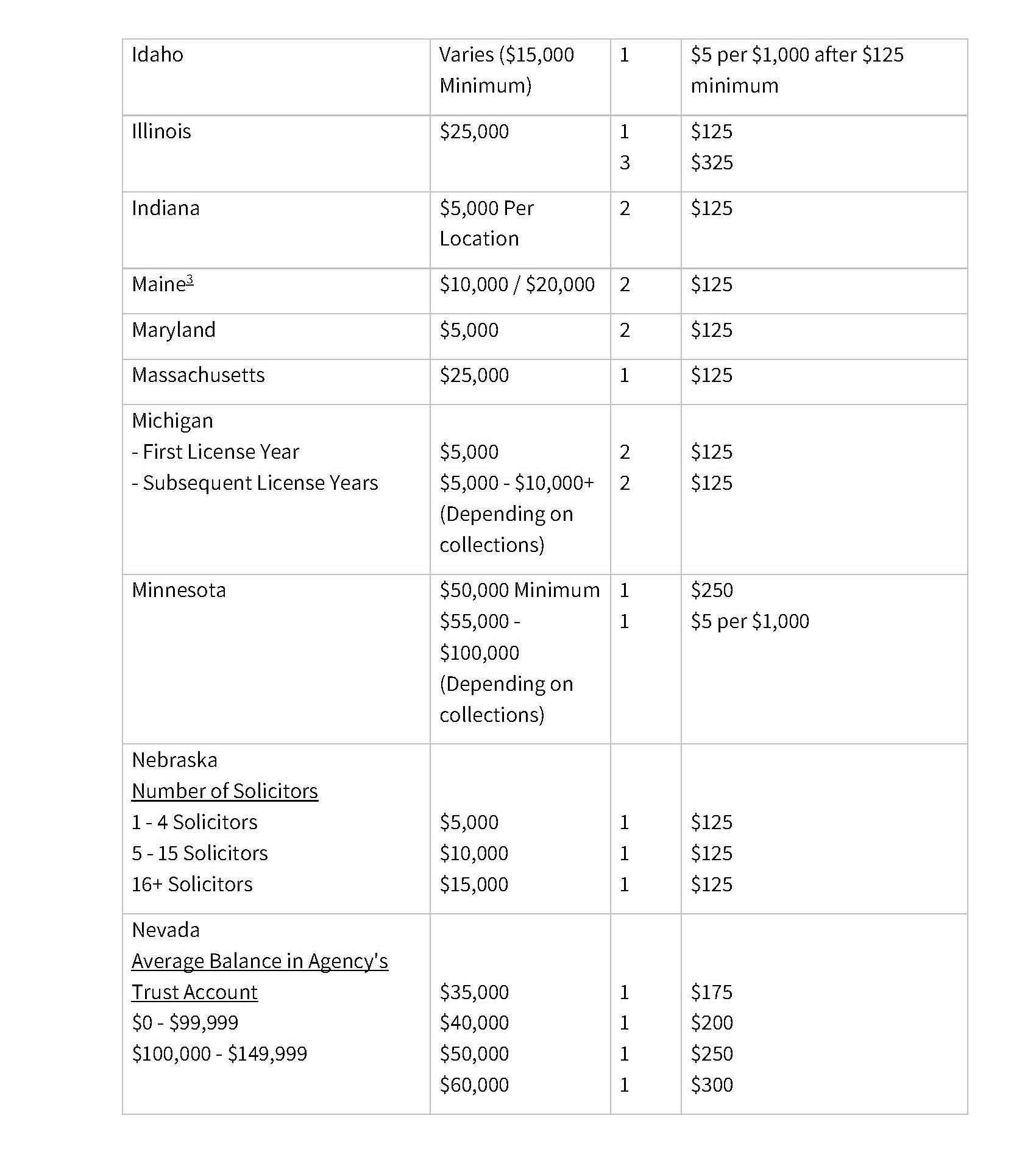

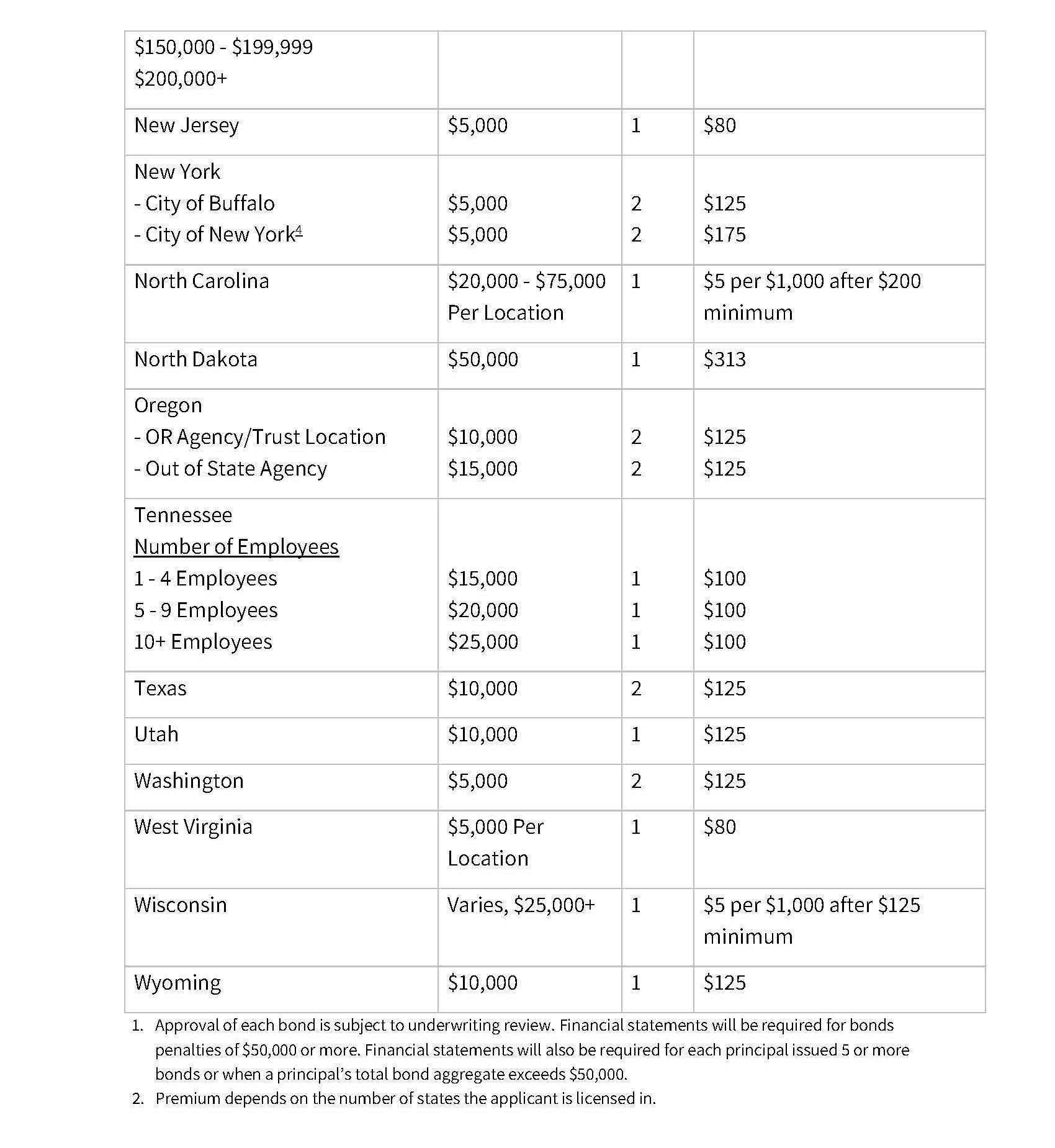

Each bond is underwritten for approval and requires a mandatory credit review. Because a collection agency bond is often considered high risk for the bonding company, due to the high volume of personal information exchanged and the guarantee that recovered funds will be properly distributed, underwriting approval is necessary.1

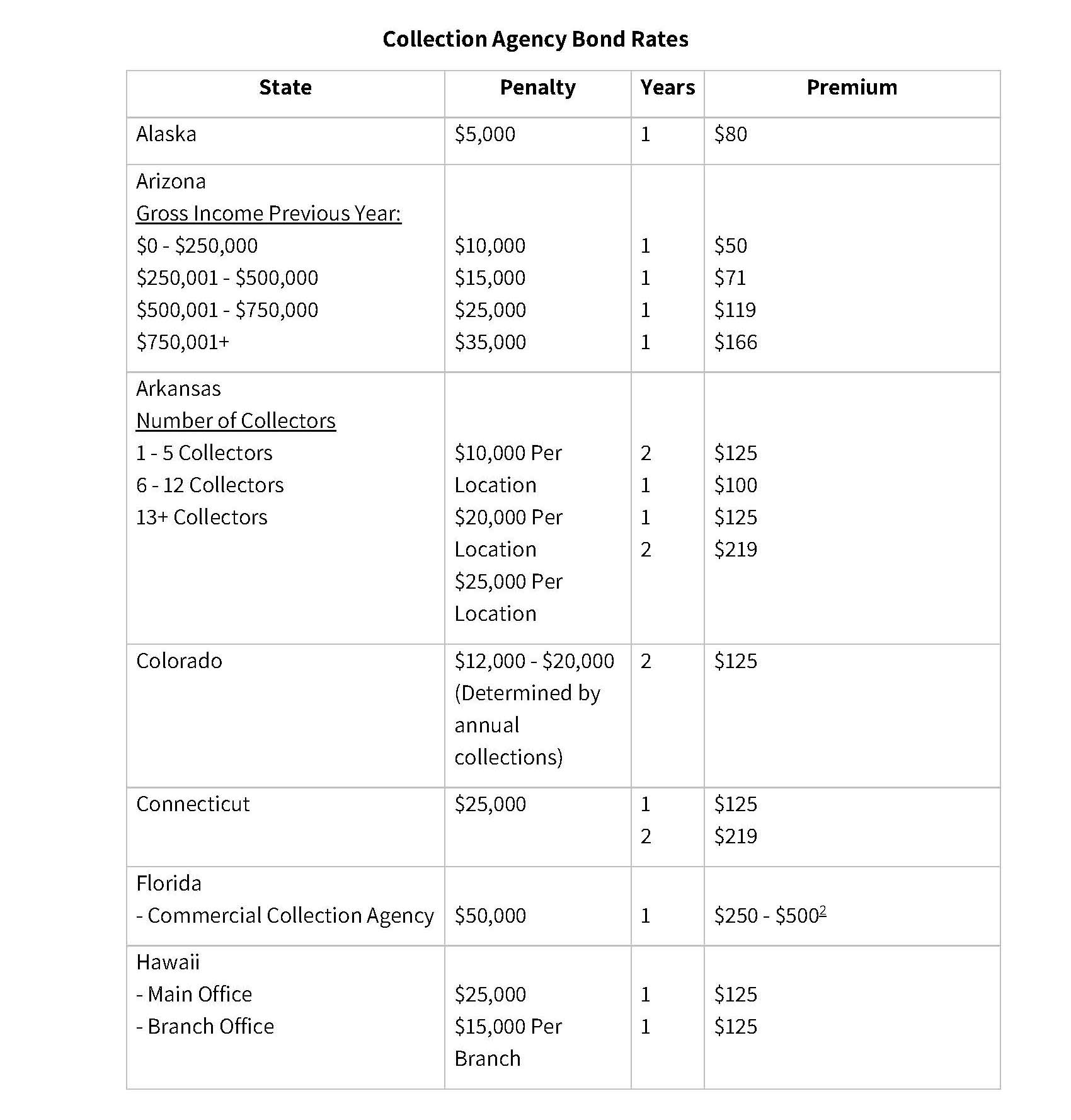

Bond amount varies by state since there is no nationwide bond requirement for licensed collection agencies, shown below.

Available Policies and Rates

If you have questions regarding the bonds shown above, or if the bond you need is not listed, please call 877-376-8676 (877-ERMUNRO) to speak with a bond team member or email us at [email protected].

Collection Agency Bond Applications

Please download the collection agency bond application from our bond application page below.

Get Started Today

As an independent agency, we are here to help you find the right Collection Agency Bonds.

Collection Agency Bonds Information Request

As an independent agency, we are here to help you find the right solution.

Request Information

It only takes a minute to get started.

- Fill out the form, we’ll be in touch.

- Review options with a bond team member.

- Get the coverage you need.